Validation of the recruiter account with a Registration / VAT Identification number

1. What is the Registration / VAT Identification number?

The VAT Identification number of an organisation is an identifier used for value added tax purposes. It confirms that the number is currently allocated to an existing legal entity and it can provide the name or other identifying information of the entity to whom the identifier has been allocated.

Should your organisation not have a VAT Identification number, you can use your organisation's registration number (another identifier that was given to your company when it was legally registered at the correspondent authority), which you will be asked to prove with legal documentation at a later stage.

2. Why is the Registration / VAT Identification number required on the ErasmusIntern.org platform?

We require all of the ErasmusIntern recruiters to submit their Registration / VAT Identification number in order to verify companies’ legal legitimacy, i.e. prove that the company is formally registered in their correspondent body. This aims to contribute to the creation of a broad pool of quality internships provided to students and recent graduates by trusted organisations.

3. How does the validation work?

The VAT identification number of your organisation will be used as an identifier for the recruiter profile on ErasmusIntern.org. For this purpose, the VAT Information Exchange System (VIES) from the European Commission will be used.

If your organisation is not registered in the VIES or does not have a VAT number, you should submit your organisation’s legal registration number. Should this be the case, your submission will be validated manually by our team of experts.

4. How quickly will my Registration / VAT Identification number be validated?

If your VAT Identification number is registered in the VIES, your number will be validated automatically. The manual verification process may take up to 7 working days. How can I obtain detailed information on the Registration / VAT Identification number of my organisation?

If you are unsure about the identification number - either VAT or Legal Registration number - of your organisation, please consult the administrative department of the institution.

5. What if the organisation that I represent does not have the VAT Identification number?

If the institution does not have any Registration / VAT Identification number, you will be asked to submit an alternative legitimacy proof once the verification email has been sent to you.

6. The Registration / VAT Identification number of my organisation has not been validated automatically. What should I do?

In this case, you will receive an email with a link to a submission form. You will be then asked to upload a digital version of the legitimacy proof.

7. I have not received the manual verification email. What should I do next?

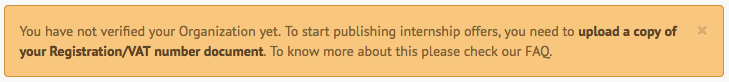

If you have not received the manual verification email, please check your spam folder first. If you cannot find the email there either, please go back to the “Edit your profile” page and click on the link you can see on the banner at the top of the page.

See below: